用 R 获取中国国债到期收益率曲线数据

楚新元 / 2021-08-18

这里直接给出代码如下,读者自行体验。

加载相关 R 包

library(dplyr)

library(purrr)

library(openxlsx)

library(ggplot2)

library(ggthemes)

编写批量获取数据的函数

cnbond_yield = \(from, to) {

# 规范化日期格式

from = lubridate::ymd(from)

to = lubridate::ymd(to)

# 参数检查,参数输入错误后给出必要的提示

test_internet = curl::has_internet()

if (!test_internet) {

stop('没有发现网络链接...')

}

if (is.na(from) | is.na(to)) {

stop('输入的起止日期参数必须是包含年月日的字符。')

}

if (to < from) {

stop('发现期初日期 > 期末日期,你把两者弄混了吗?')

}

if (to > Sys.Date()) {

stop('输入的期末日期不能大于当前日期。')

}

if (from < "2006-03-01") {

stop('数据库不包含2006年3月1日之前的数据。')

}

# 生成从起止时间段的完整的日期向量

dates = seq.Date(from = from, to = to, by = "day")

# 生成每一天的数据下载地址

url = paste0(

"http://yield.chinabond.com.cn/cbweb-mn/yc/downBzqxDetail?ycDefIds=2c9081e50a2f9606010a3068cae70001&&zblx=txy&&workTime=",

dates,

"&&dxbj=0&&qxlx=0,&&yqqxN=N&&yqqxK=K&&wrjxCBFlag=0&&locale=zh_CN"

)

# 批量下载数据到 data 文件夹下

if (!dir.exists("data")) dir.create("data")

list(

url = url, mode = "wb", quiet = TRUE,

destfile = paste0("./data/", dates, ".xlsx")

) |>

pwalk(download.file)

# # 指定最终数据文件名

# result_file = paste0(

# "cnbond", "-",

# format(from, "%Y%m%d"), "-",

# format(to, "%Y%m%d"), ".xlsx"

# )

# 批量读取非空 .xlsx 文件后合并数据

path = "./data"

path |>

list.files(

pattern = "\\.xlsx$",

full.names = TRUE

) |>

set_names() |>

map(

\(x) if (file.info(x)$size > 3400) read.xlsx(x)

) |>

list_rbind(names_to = "src") |>

select(-2) %>%

set_names(c("Date", "Term", "Rate")) |>

mutate(

Date = gsub(".*/(.*?)\\.xlsx", "\\1", Date),

Rate = as.numeric(Rate),

Term2 = case_when(

Term == 0 ~ "1D",

Term == 0 ~ "1D",

Term == 0.08 ~ "1M",

Term == 0.17 ~ "2M",

Term == 0.25 ~ "3M",

Term == 0.5 ~ "6M",

Term == 0.75 ~ "9M",

Term == 1 ~ "1Y",

Term == 2 ~ "2Y",

Term == 3 ~ "3Y",

Term == 5 ~ "5Y",

Term == 7 ~ "7Y",

Term == 10 ~ "10Y",

Term == 15 ~ "15Y",

Term == 20 ~ "20Y",

Term == 30 ~ "30Y",

Term == 40 ~ "40Y",

Term == 50 ~ "50Y",

)

)

}

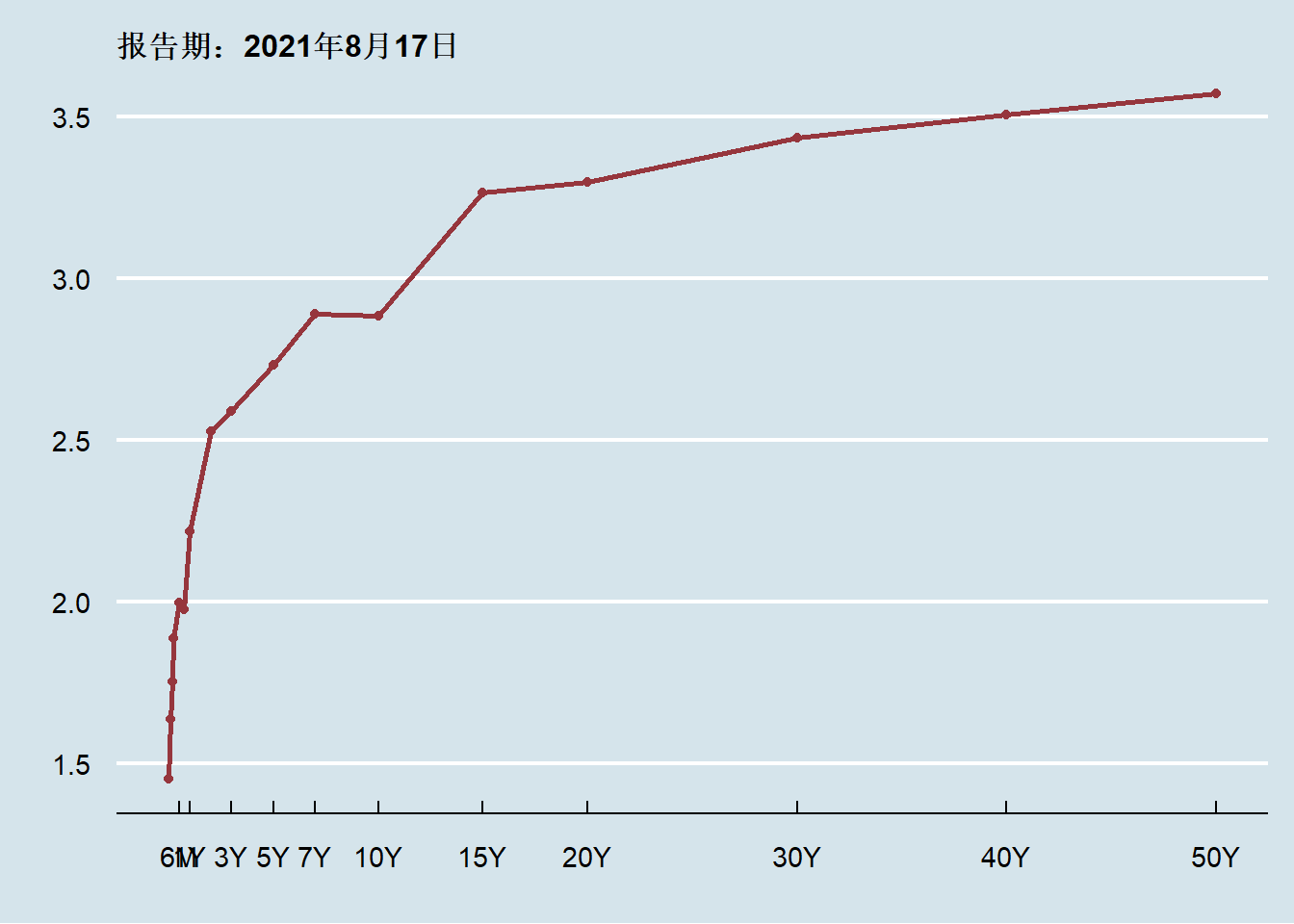

国债到期收益率曲线可视化

# 获取给定日期段数据

data = cnbond_yield(from = "20210816", to = "20210817")

# 生成国债到期收益率曲线

data %>%

# 此处以昨日数据为例

filter(Date == "2021-08-17") %>%

ggplot(aes(Term, Rate, group = 1)) +

geom_point(color = "#96363D") +

geom_line(color = "#96363D", linewidth = 1) +

theme_economist() +

theme(

legend.position = "none",

plot.title = element_text(size = 12)

) +

scale_x_continuous(

breaks = c(

0.5, 1, 3, 5, 7, 10,

15, 20, 30, 40, 50

),

labels = c(

"6M", "1Y", "3Y", "5Y", "7Y", "10Y",

"15Y", "20Y", "30Y", "40Y", "50Y"

)

) +

xlab("") + ylab("") +

ggtitle("报告期:2021年8月17日")