自相关:诊断与处理

楚新元 / 2021-09-05

如果对于不同的样本点,随机误差项之间不再是不相关的,而是存在某种相关性,则认为出现了序列相关性。 古扎拉蒂《经济计量学精要》表 10-7 给出的1980 ~ 2006年间股票价格和 GDP 的数据。

载入数据

options(digits = 4)

library(readxl)

library(dplyr)

library(kableExtra)

data = read_xls(

"data/Table10_7.xls",

skip = 4, n_max = 27

)[, 2:3]

data %>%

kable() %>%

kable_styling(

bootstrap_options = "striped",

font_size = 14

)

| NYSE | GDP |

|---|---|

| 720.1 | 2790 |

| 782.6 | 3128 |

| 728.8 | 3255 |

| 979.5 | 3537 |

| 977.3 | 3933 |

| 1143.0 | 4220 |

| 1438.0 | 4463 |

| 1709.8 | 4740 |

| 1585.1 | 5104 |

| 1903.4 | 5484 |

| 1939.5 | 5803 |

| 2181.7 | 5996 |

| 2421.5 | 6338 |

| 2639.0 | 6657 |

| 2687.0 | 7072 |

| 3078.6 | 7398 |

| 3787.2 | 7817 |

| 4827.4 | 8304 |

| 5818.3 | 8747 |

| 6546.8 | 9268 |

| 6805.9 | 9817 |

| 6397.9 | 10128 |

| 5578.9 | 10470 |

| 5447.5 | 10961 |

| 6612.6 | 11686 |

| 7349.0 | 12434 |

| 8358.0 | 13195 |

建立一元线性回归模型

model = lm(NYSE ~ GDP, data = data)

summary(model)

#>

#> Call:

#> lm(formula = NYSE ~ GDP, data = data)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -1002 -446 -101 323 1404

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -2.02e+03 3.06e+02 -6.58 6.8e-07 ***

#> GDP 7.72e-01 3.96e-02 19.52 < 2e-16 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 615 on 25 degrees of freedom

#> Multiple R-squared: 0.938, Adjusted R-squared: 0.936

#> F-statistic: 381 on 1 and 25 DF, p-value: <2e-16

自相关的诊断

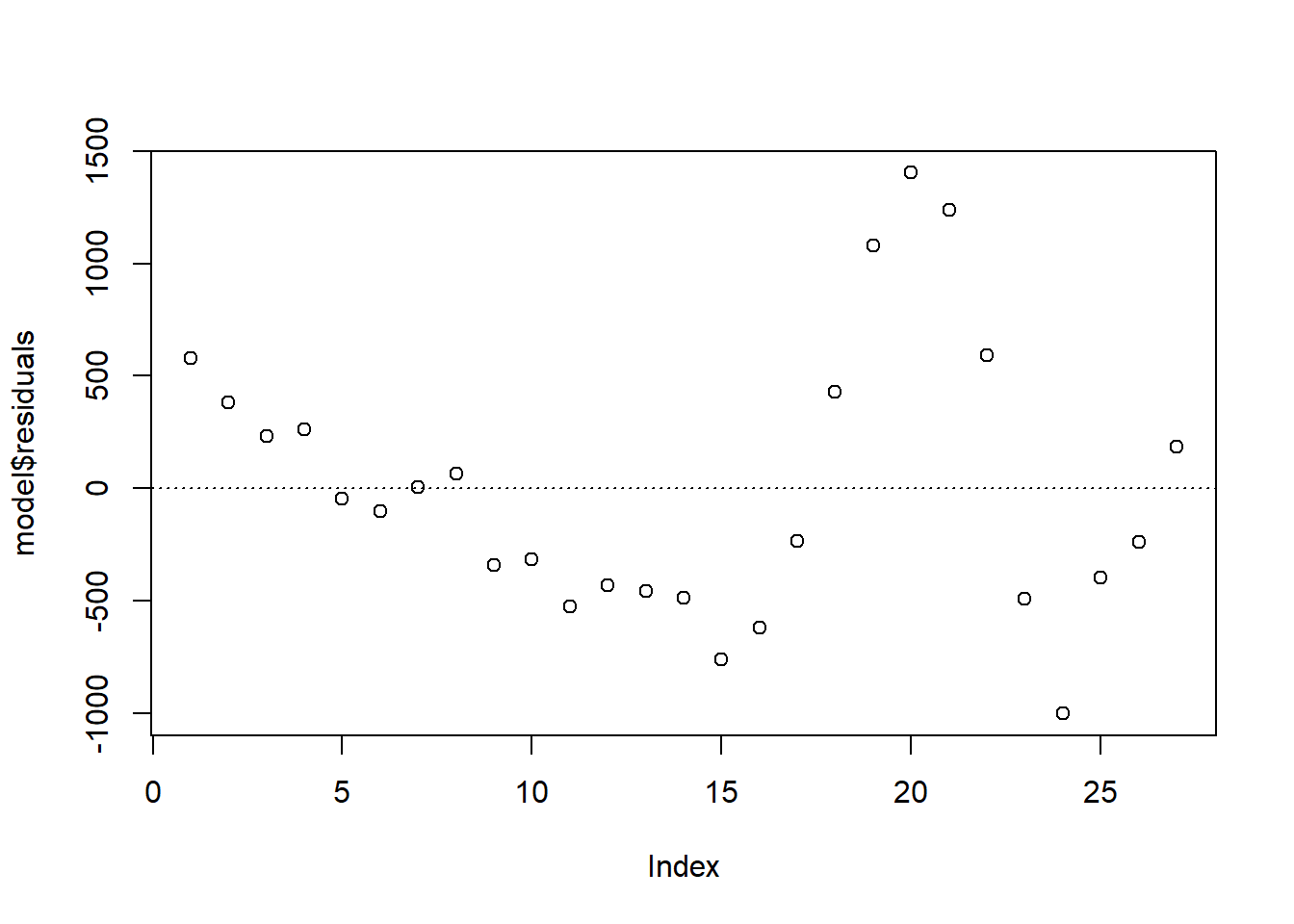

观察残差走势

# plot(model, which = 1)

plot(model$residuals)

abline(h = 0, lty = 3)

从图中可以看出,残差呈现出有规律的波动,初步判断模型存在自相关。

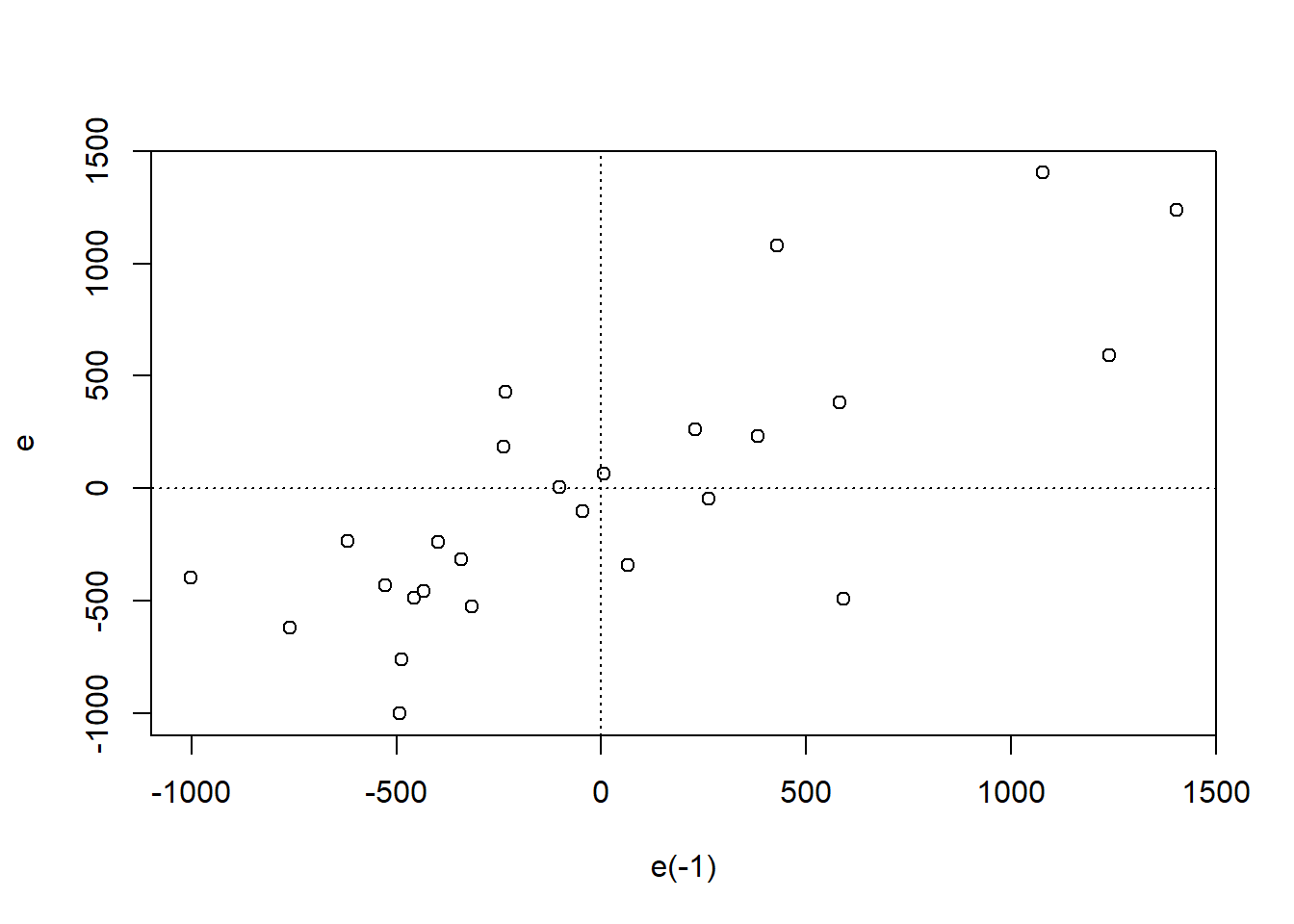

观察残差和残差滞后一阶的散点图

e = model$residuals

plot(e[-1] ~ e[-nrow(data)], xlab = "e(-1)", ylab = "e")

abline(h = 0, lty = 3)

abline(v = 0, lty = 3)

残差滞后一阶和残差散点图上,散点主要分布在一、三象限,初步判断模型存在正自相关。

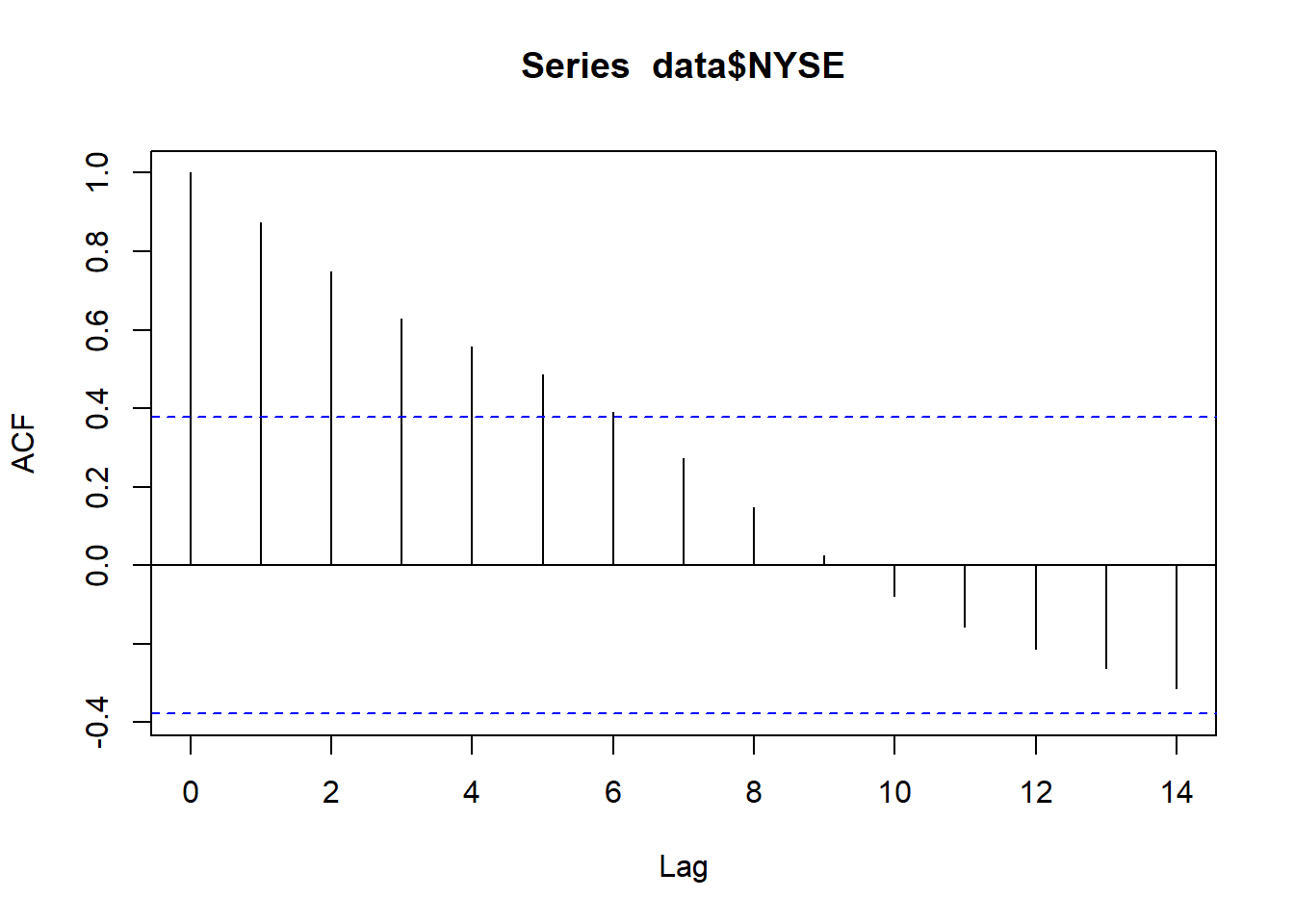

自相关图

acf(data$NYSE)

DW 一阶自相关检验

library(lmtest)

dwtest(model)

#>

#> Durbin-Watson test

#>

#> data: model

#> DW = 0.43, p-value = 2e-08

#> alternative hypothesis: true autocorrelation is greater than 0

当 n = 27, k’ = 1时,显著性水平为 5% 的 DW 统计量临界值为 1.316 和 1.469。 因为 DW 统计量的值为 0.4285,小于 1.316,因此模型存在正一阶自相关。

LM 检验

bgtest(model)

#>

#> Breusch-Godfrey test for serial correlation of order up to 1

#>

#> data: model

#> LM test = 16, df = 1, p-value = 7e-05

LM 检验拒绝无自相关原假设,表明模型存在自相关。

\(\rho\) 值通过 DW 值估计得到,用 OLS 估计广义差分方程

根据 DW 值计算 \(\rho\) 值

ρ_hat_dw = 1 - dwtest(model)$statistic / 2

names(ρ_hat_dw) = "ρ_hat_dw"

print(ρ_hat_dw)

#> ρ_hat_dw

#> 0.7858

估计原模型的 \(\beta_{1}\) 和 \(\beta_{2}\) (舍去第一个观测值)

data %>%

mutate(

NYSE_star = NYSE - ρ_hat_dw * lag(NYSE, 1), # 此处lag是滞后的意思

GDP_star = GDP - ρ_hat_dw * lag(GDP, 1)

) %>%

na.omit() %>%

lm(NYSE_star ~ GDP_star, data = .) -> model_star_lack

# 此处差分损失一个样本。

# 如果样本量足够多,可以不用补齐第一个缺失值。

# 如果样本量小,可以通过sqrt(1-ρ^2)*Y[1]、sqrt(1-ρ^2)*X[1]补齐。

beta1_lack = coef(model_star_lack)[1] / (1 - ρ_hat_dw)

beta2_lack = coef(model_star_lack)[2]

names(beta2_lack) = "GDP"

summary(model_star_lack)

#>

#> Call:

#> lm(formula = NYSE_star ~ GDP_star, data = .)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -996.2 -150.5 22.8 177.6 727.0

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -617.954 205.309 -3.01 0.0061 **

#> GDP_star 0.862 0.102 8.47 1.1e-08 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 378 on 24 degrees of freedom

#> Multiple R-squared: 0.749, Adjusted R-squared: 0.739

#> F-statistic: 71.7 on 1 and 24 DF, p-value: 1.14e-08

# 利用 DW-test 对 model_star_lack 模型进行检验

dwtest(model_star_lack)

#>

#> Durbin-Watson test

#>

#> data: model_star_lack

#> DW = 0.91, p-value = 5e-04

#> alternative hypothesis: true autocorrelation is greater than 0

# 利用 LM-test 对 model_star_lack 模型进行检验

bgtest(model_star_lack)

#>

#> Breusch-Godfrey test for serial correlation of order up to 1

#>

#> data: model_star_lack

#> LM test = 7.6, df = 1, p-value = 0.006

还原后的估计方程: $$ \widehat{NYSE} = -2884.2875 + 0.8624 * GDP $$

估计原模型的 \(\beta_{1}\) 和 \(\beta_{2}\) (包含第一个观测值)

data %>%

mutate(

NYSE_star = NYSE - ρ_hat_dw * lag(NYSE, 1),

GDP_star = GDP - ρ_hat_dw * lag(GDP, 1),

NYSE_star_1 = sqrt(1-ρ_hat_dw^2) * NYSE * c(1,rep(0,nrow(data)-1)),

GDP_star_1 = sqrt(1-ρ_hat_dw^2) * GDP * c(1,rep(0,nrow(data)-1))

) -> data_NA

data_NA$NYSE_star[is.na(data_NA$NYSE_star)] = 0

data_NA$GDP_star[is.na(data_NA$GDP_star)] = 0

data_NA %>%

mutate(

NYSE_star_full = NYSE_star + NYSE_star_1,

GDP_star_full = GDP_star + GDP_star_1

) %>%

lm(

NYSE_star_full ~ GDP_star_full,

data = .

) -> model_star_full

beta1_full = coef(model_star_full)[1] / (1 - ρ_hat_dw)

beta2_full = coef(model_star_full)[2]

names(beta2_full) = "GDP"

summary(model_star_full)

#>

#> Call:

#> lm(formula = NYSE_star_full ~ GDP_star_full, data = .)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -983.4 -179.8 37.8 194.1 741.1

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -642.233 204.978 -3.13 0.0044 **

#> GDP_star_full 0.867 0.102 8.48 7.9e-09 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 380 on 25 degrees of freedom

#> Multiple R-squared: 0.742, Adjusted R-squared: 0.732

#> F-statistic: 72 on 1 and 25 DF, p-value: 7.91e-09

# 利用 DW-test 对 model_star_full 模型进行检验

dwtest(model_star_full)

#>

#> Durbin-Watson test

#>

#> data: model_star_full

#> DW = 0.92, p-value = 5e-04

#> alternative hypothesis: true autocorrelation is greater than 0

# 利用 LM-test 对 model_star_full 模型进行检验

bgtest(model_star_full)

#>

#> Breusch-Godfrey test for serial correlation of order up to 1

#>

#> data: model_star_full

#> LM test = 7, df = 1, p-value = 0.008

还原后的估计方程: $$ \widehat{NYSE} = -2997.6114 + 0.867 * GDP $$

\(\rho\) 值通过 OLS 残差估计得到

根据 OLS 残差估计 \(\rho\) 值

uxfit = lm(

model$residuals ~ 0 + lag(model$residuals),

data = data

)

ρ_hat_ols = coef(uxfit)[1]

names(ρ_hat_ols) = "ρ_hat_ols"

print(ρ_hat_ols)

#> ρ_hat_ols

#> 0.7689

估计原模型的 \(\beta_{1}\) 和 \(\beta_{2}\) (舍去第一个观测值)

data %>%

mutate(

NYSE_star = NYSE - ρ_hat_ols * lag(NYSE, 1),

GDP_star = GDP - ρ_hat_ols * lag(GDP, 1)

) %>%

na.omit() %>%

lm(

NYSE_star ~ GDP_star,

data = .

) -> model_star_lack2

# 此处差分损失一个样本。

# 如果样本量足够多,可以不用补齐第一个缺失值。

# 如果样本量小,可以通过sqrt(1-ρ^2)*Y[1]、sqrt(1-ρ^2)*X[1]补齐。

beta1_lack2 = coef(model_star_lack2)[1] / (1 - ρ_hat_ols)

beta2_lack2 = coef(model_star_lack2)[2]

names(beta2_lack2) = "GDP"

summary(model_star_lack2)

#>

#> Call:

#> lm(formula = NYSE_star ~ GDP_star, data = .)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -985.7 -149.8 21.5 178.3 735.0

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -647.2103 205.0171 -3.16 0.0043 **

#> GDP_star 0.8547 0.0957 8.93 4.3e-09 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 379 on 24 degrees of freedom

#> Multiple R-squared: 0.769, Adjusted R-squared: 0.759

#> F-statistic: 79.7 on 1 and 24 DF, p-value: 4.29e-09

# 利用 DW-test 对 model_star_lack2 模型进行检验

dwtest(model_star_lack2)

#>

#> Durbin-Watson test

#>

#> data: model_star_lack2

#> DW = 0.9, p-value = 4e-04

#> alternative hypothesis: true autocorrelation is greater than 0

# 利用 LM-test 对 model_star_lack2 模型进行检验

bgtest(model_star_lack2)

#>

#> Breusch-Godfrey test for serial correlation of order up to 1

#>

#> data: model_star_lack2

#> LM test = 7.8, df = 1, p-value = 0.005

还原后的估计方程: $$ \widehat{NYSE} = -2800.1965 + 0.8547 * GDP $$

估计原模型的 \(\beta_{1}\) 和 \(\beta_{2}\) (包含第一个观测值)

data %>%

mutate(

NYSE_star = NYSE - ρ_hat_ols * lag(NYSE, 1),

GDP_star = GDP - ρ_hat_ols * lag(GDP, 1),

NYSE_star_1 = sqrt(1-ρ_hat_ols^2) * NYSE * c(1,rep(0,nrow(data)-1)),

GDP_star_1 = sqrt(1-ρ_hat_ols^2) * GDP * c(1,rep(0,nrow(data)-1))

) -> data_NA2

data_NA2$NYSE_star[is.na(data_NA2$NYSE_star)] = 0

data_NA2$GDP_star[is.na(data_NA2$GDP_star)] = 0

data_NA2 %>%

mutate(

NYSE_star_full = NYSE_star + NYSE_star_1,

GDP_star_full = GDP_star + GDP_star_1

) %>%

lm(

NYSE_star_full ~ GDP_star_full,

data = .

) -> model_star_full2

b1_full2 = coef(model_star_full2)[1] / (1 - ρ_hat_ols)

b2_full2 = coef(model_star_full2)[2]

names(b2_full2) = "GDP"

summary(model_star_full2)

#>

#> Call:

#> lm(formula = NYSE_star_full ~ GDP_star_full, data = .)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -974.1 -180.7 36.1 194.2 748.4

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) -673.4730 204.2343 -3.30 0.0029 **

#> GDP_star_full 0.8601 0.0959 8.97 2.8e-09 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 380 on 25 degrees of freedom

#> Multiple R-squared: 0.763, Adjusted R-squared: 0.753

#> F-statistic: 80.4 on 1 and 25 DF, p-value: 2.75e-09

# 利用 DW-test 对 model_star_full2 模型进行检验

dwtest(model_star_full2)

#>

#> Durbin-Watson test

#>

#> data: model_star_full2

#> DW = 0.92, p-value = 4e-04

#> alternative hypothesis: true autocorrelation is greater than 0

# 利用 LM-test 对 model_star_full2 模型进行检验

bgtest(model_star_full2)

#>

#> Breusch-Godfrey test for serial correlation of order up to 1

#>

#> data: model_star_full2

#> LM test = 7.2, df = 1, p-value = 0.007

还原后的估计方程: $$ \widehat{NYSE} = -2913.8235 + 0.8601 * GDP $$

利用一阶差分法对变换后的模型进行估计

data %>%

mutate(

NYSE_star = NYSE - lag(NYSE, 1),

GDP_star = GDP - lag(GDP, 1)

) %>%

na.omit() %>%

lm(

NYSE_star ~ 0 + GDP_star,

data = .

) -> model_star_3

beta2_3 = coef(model_star_3)

names(beta2_3) = "GDP"

beta1_3 = mean(data$NYSE) - beta2_3 * mean(data$GDP)

names(beta1_3 ) = "Intercept"

summary(model_star_3)

#>

#> Call:

#> lm(formula = NYSE_star ~ 0 + GDP_star, data = .)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -1115.6 -238.5 -34.7 103.3 616.9

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> GDP_star 0.868 0.183 4.75 7.1e-05 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 401 on 25 degrees of freedom

#> Multiple R-squared: 0.474, Adjusted R-squared: 0.453

#> F-statistic: 22.6 on 1 and 25 DF, p-value: 7.14e-05

# 利用 LM-test 对 model_star_3 模型进行检验

bgtest(model_star_3)

#>

#> Breusch-Godfrey test for serial correlation of order up to 1

#>

#> data: model_star_3

#> LM test = 7.1, df = 1, p-value = 0.008

还原后的估计方程: $$ \widehat{NYSE} = -2701.4792 + 0.8684 * GDP $$